Tuition Installment Payment: After college students have decided to pursue higher education, they are often met with the reality of its cost.

The excitement of acceptance letters can quickly be overshadowed by the stress of figuring out how to finance tuition fees that seem to climb each year.

The common types of financial aid include scholarships, grants, work-study programs, and traditional student loans. Each comes with its rules, requirements, and, often, future payback obligations.

Tuition installment plans are swiftly becoming the new normal in our world, historically dominated by hefty loans and stringent grant qualifications; still, they are not without challenges.

Despite their growing popularity, many students and families still need to learn how these plans operate and stack up against traditional financial aid options.

This article covers a detailed comparative analysis of tuition installment payment solutions and other financial aid options.

Table of Contents

A Brief Overview of Tuition Installment Plans and Other Financing Options

Tuition Installment Plans:

These plans break down the large lump sum of tuition into smaller, more manageable payments and spread out over a period, typically aligning with the academic term.

Unlike traditional loans, these plans usually come with little to no interest, making them a cost-effective alternative.

They are designed to ease the burden of upfront tuition costs, allowing students to pay as they learn without the long-term debt associated with student loans.

Federal and Private Loans:

Loans are one of the most widely used forms of financial aid. Federal loans, backed by the government, often have lower interest rates and more flexible repayment options than private loans.

Private loans, offered by banks and other financial institutions, can fill the gaps not covered by federal aid but may come at the cost of higher interest rates and more stringent repayment schedules.

Grants and Scholarships:

Grants are need-based aids that do not require repayment, making them highly sought after.

Scholarships are awarded based on various criteria, including academic merit, athletic ability, or other talents and do not need to be repaid.

Both grants and scholarships are considered gift aid and are ideal for students as they directly reduce the cost of education without the burden of repayment.

Work-Study Programs

These programs provide part-time jobs for undergraduate and graduate students with financial need, allowing them to earn money to help pay education expenses. The program encourages community service work and work related to the student’s course of study.

Income Share Deals(ISAs):

A newer alternative, ISAs allow students to finance their education by agreeing to pay a percentage of their future income for a set period after graduation.

This option can be attractive as it aligns the cost of education with the success of the student post-graduation.

What Is the Difference Between Tuition Installment Plan and Other Financing Aid Options?

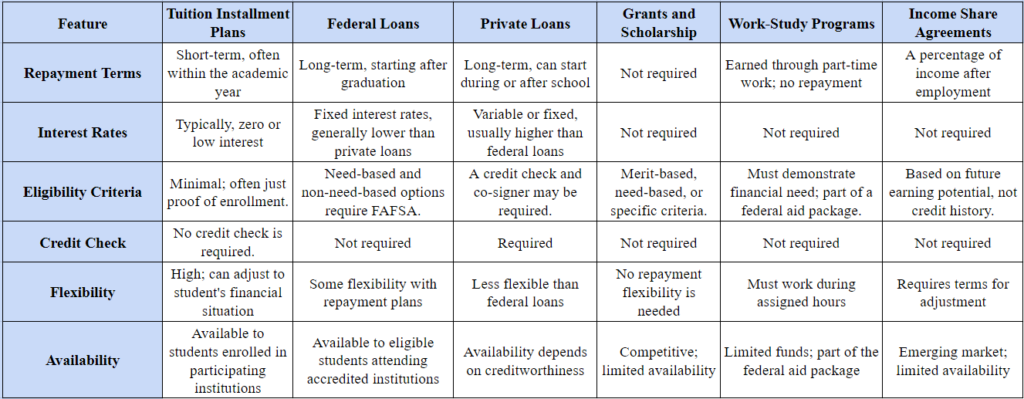

The table below highlights the key differences between tuition installment plans and other financing aid options:

What Are the Similarities Between Tuition Installment Plans and Other Financing Aid Options?

Tuition installment plans and other financial aid options, despite their differences, share several common objectives and characteristics:

Purpose of Aid

Both tuition installment plans and other financial aid options like loans, grants, and scholarships are designed to help students cover the costs of their education. They aim to make higher education more accessible to a broader range of students.

Benefit to Students

All these options provide a financial benefit to students, either by reducing the upfront cost of education, spreading out payments over time, or providing funds that do not need to be repaid.

Institutional Partnerships

Tuition installment plans, like federal loans and some scholarships, often require partnerships between the financial service provider and the educational institution. These partnerships help to integrate the aid with the institution’s billing and enrollment processes.

Impact on Education Access

Each of these options can significantly impact a student’s ability to access higher education. By alleviating the financial burden, they enable students who might otherwise be unable to afford college to attend.

Financial Planning for Students

Tuition installment plans, loans, and income share agreements all require some level of financial planning from students. They must understand the terms and conditions and plan for their current and future financial commitments.

Conclusion: Tuition Installment Payment

As colleges seek to empower their students with various financial aid options, it’s crucial to provide clear, comprehensive information to facilitate informed decisions.

Tuition installment plans are flexible and often more affordable for managing education costs.

For institutions looking to enhance their financial aid offerings and support student success, GratifyPay presents a seamless solution.

FAQs

How to Get on an Installment Plan for Tuition?

To enroll in an installment plan for tuition, contact your educational institution’s financial aid office or billing department. They will provide details on available plans, requirements, and payment schedules. Typically, you’ll need to submit an application or request form and adhere to specified deadlines for installment payments.

Should I Pay Full Tuition vs. Installment Plan?

The decision between paying full tuition or opting for an installment plan depends on your financial situation and preferences. If you have the means to pay upfront without financial strain, it might save you on potential interest or fees. However, an installment plan offers the flexibility to spread payments over time, making education more accessible for those on a budget.

What is Tuition Installment Plan?

A tuition installment plan is a payment option offered by educational institutions that allows students to pay their tuition and fees in multiple installments rather than as a lump sum. This eases the financial burden on students and their families, providing a more manageable approach to covering the costs of education. Installment plans typically involve regular, scheduled payments throughout the academic term.